In March of 2023, only nine months ago, we had a round-the-clock war room set up in River CEO Alex Leishman’s New York loft. We had a constant call on speaker phone with our General Counsel and Director of Finance in San Francisco. Banks were failing – Silvergate, Signature, SVB, then First Republic. River was never at risk of being non-operational, but the Bitcoin industry was exposed. The entire tech sector was under duress.

It was a moment of chaos that felt all too familiar. Five months prior, FTX had failed, dragging down the crypto industry and most importantly, consumer confidence in the space. While chaotic, we felt prepared. Stressed, as any leadership should be, but ready.

I attribute this preparedness in large part to Alex’s leadership and perspective. Alex has spent over a decade in Bitcoin and understands what it takes to build an enduring company. Typical economic boom and bust cycles occur over decades-long periods, but Bitcoin cycles occur 10 times more frequently.

We have operated River with a mentality that did not conform to the Silicon Valley “raise, spend, and grow at all costs” mindset.

We aimed to grow with rigor, solving real problems for great clients. To thrive as a business in Bitcoin, you have to survive. Great entrepreneurs manage risk, a competency that went uncelebrated in a zero-interest rate environment when the next fundraising round always felt right around the corner.

Knowing the reality of building a Bitcoin company in this inherently unique industry, we did a few things differently that prepared us to survive, if not thrive, in chaos:

- Build an indestructible core, a bedrock:

When there is uncertainty, you have to adapt to the realities of your industry and control what you can. Do not take shortcuts on the foundation. In Bitcoin, this comes down to custody and liquidity. We built our own multi-sig cold storage Bitcoin custody and maintain 100% full reserves. We do not rely on third parties because as we’ve seen, you never truly know what’s happening behind the veil. As a business owner and operator, you have to ask: is there any third party that could kill your company? We work hard to ensure that is never the case. - Invest in the company operating system:

We invested in our people, communication, and systems. We run lean, focused on increasing efficiency and productivity before headcount. It makes coordination easier, but also gives employees the opportunity to grow and take on more responsibility. In prior companies, I’ve seen productivity gaps get filled with new hires. This type of problem-solving doesn’t scale. At River, we fill gaps with automation first.

As an example, we have 10xed our number of monthly orders from one year ago. December 2023 was a record-breaking month for River in trading volume, order volume, and new client accounts. In this time, our Financial Operations team has stayed the same size. Their roles, contributions, and career trajectories have 10xed. This type of company culture attracts and retains A player talent. Our operating system is a flywheel of investing in people who build systems, which grow the business, which creates more opportunities for our people. - Do fewer things exceptionally well:

In the bear market, we narrowed our strategic focus. We locked in on being the best place to buy, hold, and transact in Bitcoin. Our Product and Engineering team launched zero-fee recurring orders, target price orders, and River Link. Marketing and Research published in-depth reports on the role of Bitcoin in cross-border payments and the Lightning Network. Our Relationship Management and Client Services teams provided exceptional service day in and day out to our clients. Your referrals continue to be River’s primary growth engine and for that, we’re deeply grateful. - Come back to your mission and vision:

River’s mission is to champion an honest and robust financial system by accelerating the adoption of Bitcoin, the world’s only incorruptible digital currency. As leaders, we are fortunate to operate in a space that is innately inspirational. I cannot imagine leading a company that sells toilet paper and finding ways to inspire others. Bitcoin is bigger than us and is improving the lives of people around the world, first by protecting their savings. In the moments of chaos, we always came back to our mission to center us and to charge ahead with fortitude.

As we’re on the cusp of a spot Bitcoin ETF decision, the industry feels markedly different from one year ago.

As Alex said to me this week, “It feels like we’re in the foothills of a bull market.” In 2023, bitcoin saw 150% price appreciation, yet still well below the all-time high. We are not seeing the irrational exuberance of prior days, but we are seeing a consistent groundswell of institutional interest in Bitcoin and operators looking to hold bitcoin on their company balance sheets.

What’s ahead in the next few months could be ground-breaking. Wherever we are in the economic cycle, we’ll be here building at River and continuing to do our part in pushing Bitcoin forward.

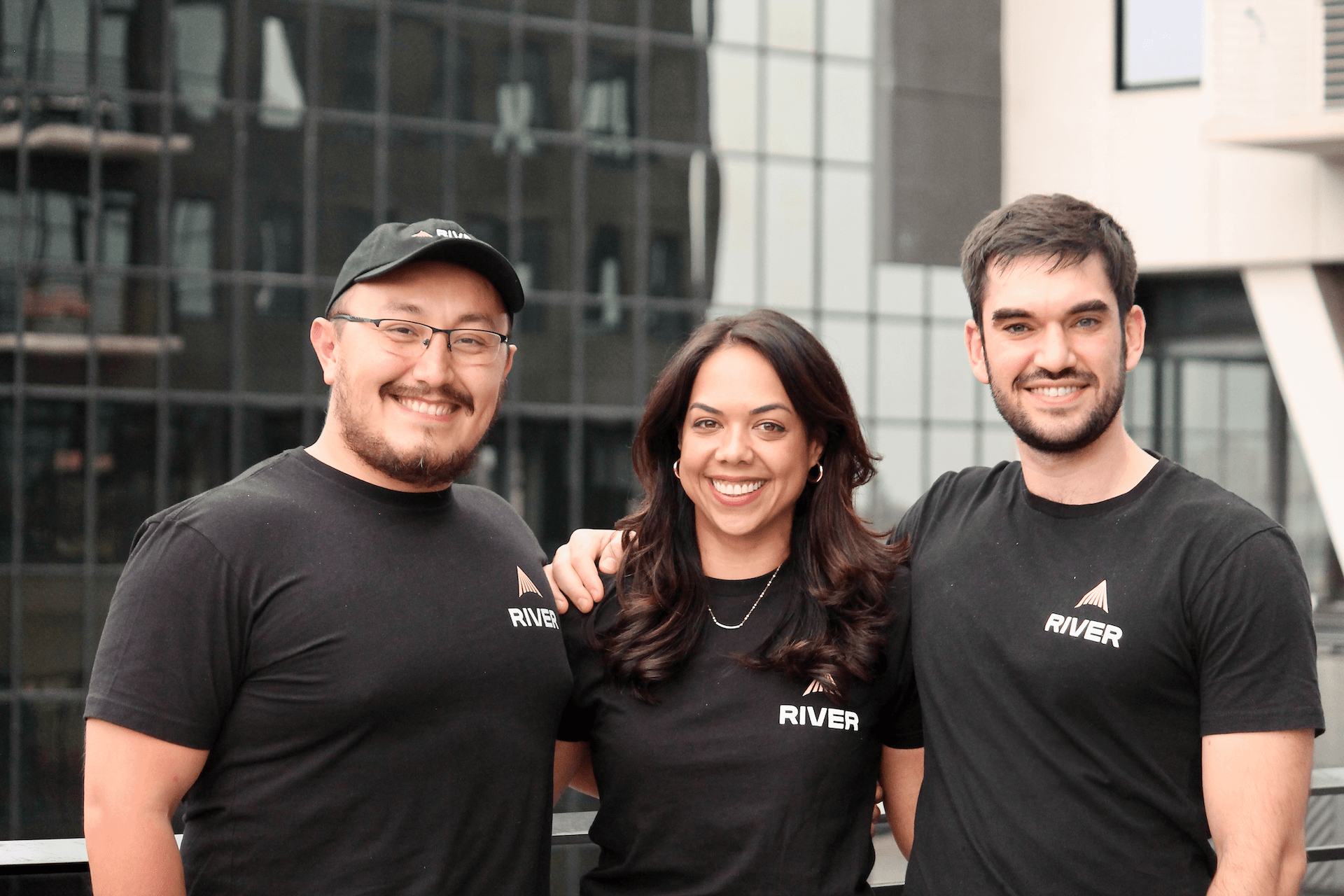

Julia Duzon, River COO