In this post I reflect on what we have accomplished over the last year at River and give some insights into the numbers behind our business now that we have been up and running for a few months.

River Financial is dedicated to building the best platform for individuals and institutions to buy, sell and manage Bitcoin. Our long-term mission is to bring Bitcoin to the world. If you’re interested in seeing what we have to offer, you can request an invitation here: river.com/signup

The Road to Launch

Getting Started

When Andrew and I started River Financial a year ago we had nothing but an idea and the drive to make it a reality. Naturally, one of the first things we did was get some office space and buy a few posters to set the tone and philosophical foundation for the company.

The above poster means a lot to Andrew and I. Some of you may know that we are cousins. What some of you may not know is that our grandmother told us stories growing up about how President Franklin Roosevelt stole her father's gold under Executive Order 6102. We keep this hanging on the wall as a reminder that the fight to give people sovereignty over their wealth is not a new one.

F.A. Hayek helped lay out a vision for what a world with non-government money could look like in his essay The Denationalization of Money. His writing inspired my interest in Bitcoin, and River would not exist today had I not read his works.

The last poster we bought was the infamous front page of The Times with the headline Satoshi put in the genesis Bitcoin block. This poster reminds us daily of where it all began.

Once we had put the posters up, we had some real work to do...

Compliance

Starting a company like River eight years ago would have been a much more affordable endeavor. Bitcoin services in the United States were largely unregulated and you could get to market on a shoestring budget with a bank account and some decent programming chops.

However, as they always do, regulations caught up with our industry on both the federal and state levels. Today, Bitcoin services like River must register with FinCEN as a Money Services Business. At the state level, we are required to acquire Money Transmitter Licenses (MTLs) in most states in the US – an expensive and time-consuming process.

Over the last year, Andrew has diligently led the charge on compliance, building a rock solid foundation that will allow us to operate in the majority of the United States by this summer. This diligence has also prepared us well for establishing strong bank partnerships.

Here are some numbers to quantify our compliance work: we have spent hundreds of thousands of dollars and hundreds of hours writing over one-thousand pages of compliance policies, engaging in a full financial audit and working with lawyers and regulatory experts to guide us through murky legal waters.

1,000 pages of compliance policies

23 Money Transmitter Licenses in-flight

If reading about our compliance policies doesn’t excite you, maybe the software engineering side of things will.

Software

As the CEO & CTO, I have spent the vast majority of my time over the last year designing and building our technical infrastructure alongside a team of insanely talented colleagues.

At River we have developed some core engineering principles that have guided us as we have built our systems:

Build for the long-term

We have ambitious goals. We want to help bring a monetary revolution to the world and that will not happen overnight. In order to achieve that goal our systems must be flexible, secure and scale well as we grow.

The first problem we faced was the lack of quality Bitcoin software built for our multi-user needs. Bitcoin core is incredible software for P2P consensus, but its built-in wallet is not suitable for a company like River. Therefore, we built our own Bitcoin wallet infrastructure allowing us to offer an incredible array of custodial and non-custodial services over the coming months and years. Phil Glazman was the brains behind this effort and his tweet thread provides some more insight into what we have built here.

Security First

If River is going to be the world’s premier Bitcoin financial institution, it also needs to be the world’s most secure Bitcoin financial institution. We decided early on that we could not have sufficient security by hosting our core applications in the cloud. Building our company on a foundation controlled by Google, AWS or Microsoft was untenable. We needed a foundation of concrete, not sand.

Therefore, we spent the time to build out our own physical server infrastructure. This effort was led by our incredible Chief Security Officer Jonathan Wilkins. Jonathan has had a long and storied career in both the security and Bitcoin worlds. So far we are very happy with the decision to own our hardware.

We are focused on continually strengthening this infrastructure foundation over the coming months and years with cutting edge security tools. If you are a security-minded DevOps or infrastructure engineer in San Francisco interested in getting your hands dirty with both physical servers and software please reach out. I'm sure you can figure out how to contact us ;)

Build with the tools that feel right, even if they aren’t super popular

Before building out our web application, I was trying to decide between using Ruby on Rails, a technology that I have used for years and was very comfortable with, or a newer programming language called Elixir. I had built some toy projects with Elixir and the Phoenix web framework before, but had never shipped anything to production. I spent about a week experimenting and weighing the pros and cons of Ruby vs. Elixir. Eventually, I knew that despite the learning curve and smaller community, Elixir was the right tool for the job. Its performance, functional nature and high quality tooling made it perfect to serve as the foundational language for our web applications.

Another reason I was attracted to Elixir and Phoenix was that it would allow us to build reactive and dynamic web applications without writing much JavaScript. Almost all of our dynamic UI logic runs on our server. I will describe how this magic works in a future blog post.

Kafai Choi, our second engineer to join the team, is deeply experienced with Elixir. Since joining River, he has done an incredible job leading the development of our web applications. Kafai brings such a level of craftsmanship and dedication to his work that I can truly say that I am very proud of our codebase.

In hindsight, choosing Elixir for our web applications has worked out beautifully. Our web applications perform very well and handle errors gracefully. We are also able to move fast while keeping maintainable abstractions with well documented interfaces. There are some challenges when using Elixir with Kubernetes due to the stateful nature of certain features of the Erlang Virtual Machine, but these are minor and straightforward to deal with.

Our Tech Stack

Elixir, Go, JavaScript (just a little bit)

Kubernetes

Self-hosted physical servers

The Numbers

While River is still invite-only we are continually onboarding new individual and institutional clients. Here is an overview of some of the trends that we are seeing.

Buy/Sell

The vast majority of our users are exclusively buying Bitcoin. In fact 95% of all of our volume has been from clients buying Bitcoin!

Recurring Orders

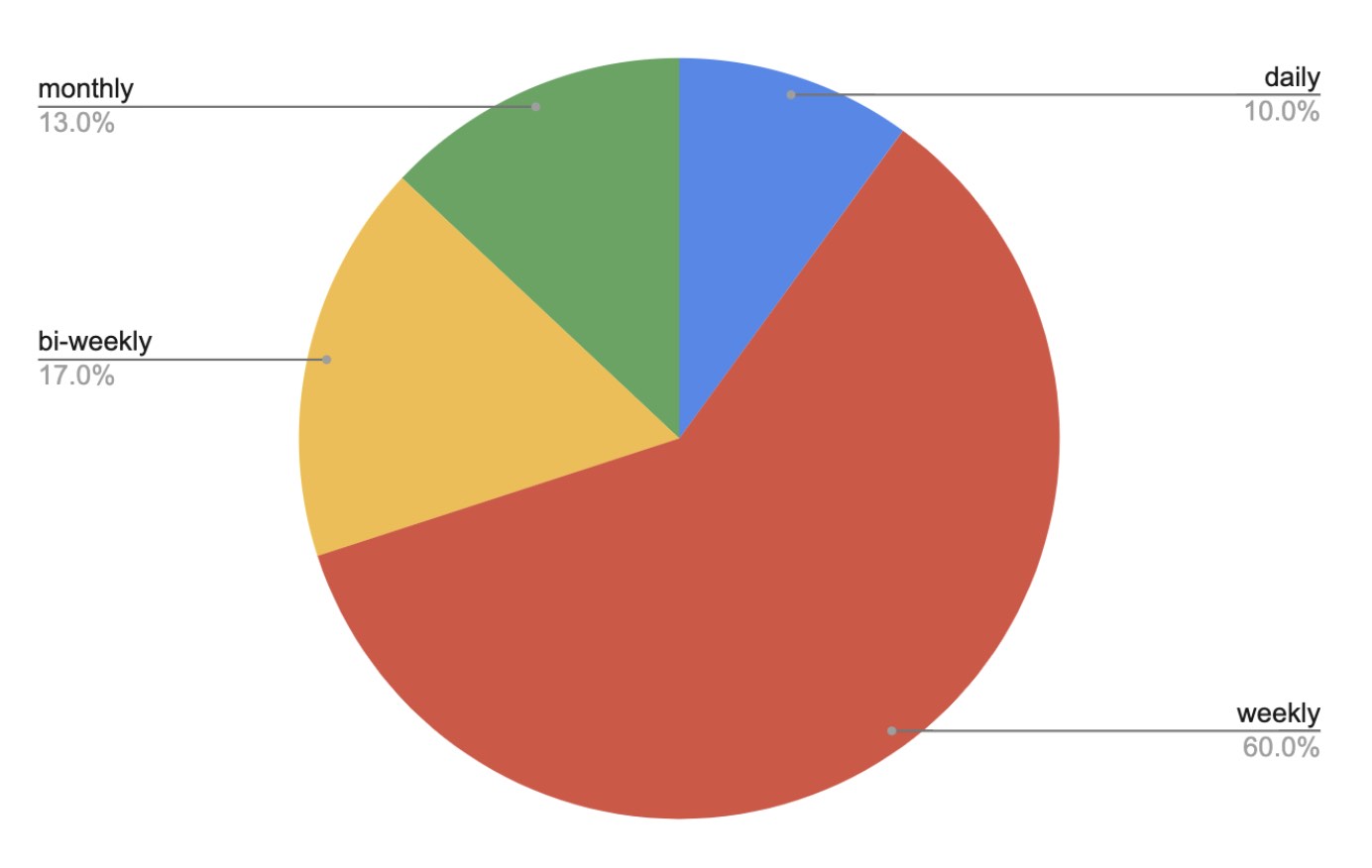

On the River platform we encourage users to setup an automated recurring Bitcoin purchase to buy Bitcoin over time. Our clients seem to like this feature, since over 25% have setup a recurring purchase.

Recurring Order Breakdown

The majority of clients choose to setup a weekly recurring purchase; however, a non-negligible amount of people are buying Bitcoin daily.

These numbers are starting to paint a beautiful picture of the type of clients we attract. Our clients are long-term thinkers. They are not trading in and out of their positions to make a quick buck, they are long-term believers in Bitcoin with strong hands.

Transactions

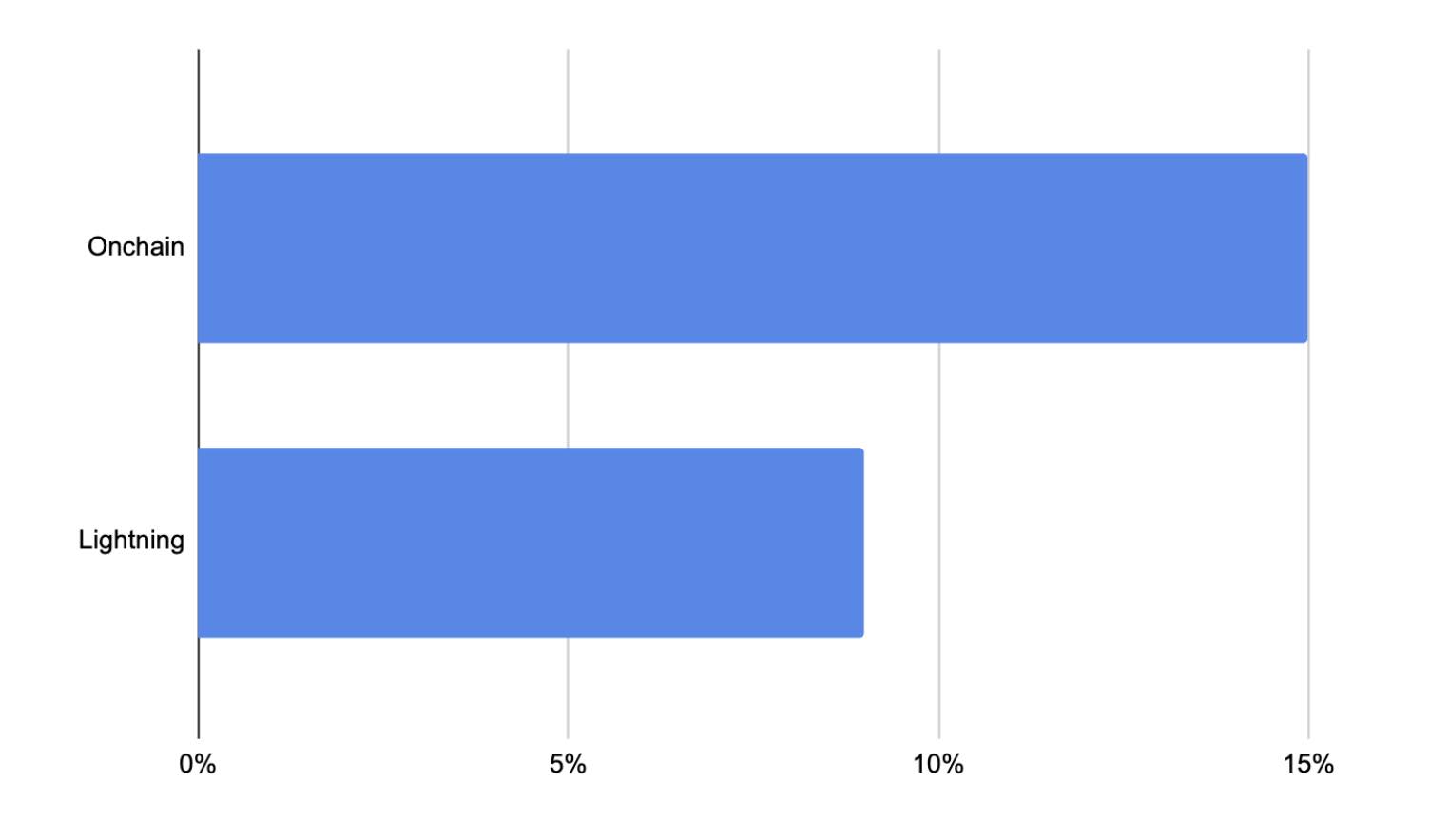

The majority of our clients choose to store their Bitcoin with us. However a solid portion of clients are power users who self-custody their coins and regularly use our on-chain and Lightning Network functionality.

% of Clients who have made Lightning and On-chain transactions

We have a solid contingent of Bitcoin power-users leading the way on our service. It’s always exciting to see a new client buy Bitcoin and withdraw it on-chain or on the Lightning Network. It’s something that we encourage our clients to do and I am happy to see that over 15% of our clients are using the Bitcoin native functionality we offer.

The future

We've made incredible progress over the past year, and I could not be more proud of our team. 2019 was the year of building the foundation for River Financial. 2020 will be the year we ship feature after feature with a laser focus on bringing the world the best of Bitcoin. To follow our progress, signup for an invitation and follow us on Twitter.

Thank you to all of our clients and supporters who have helped us get to this point. We truly appreciate each and every one of you. To those who have requested access and are in jurisdictions we cannot support please know that we are working as fast as we can to get to you!