As a (potential) client, you may be wondering how the buying and selling of bitcoin works behind the scenes at River. Are you being offered a fair price? What happens to your data? Are your assets ever at risk?

These questions may not seem like the most pleasant to consider, but there have been plenty of bad practices in the industry, even among the best known brands. We believe it is important for anyone interested in Bitcoin to know what they are signing up for. We hate to see any Bitcoiner get burned and lose money, especially to a business in the industry with poor risk management.

In this post we want to help you understand how our bitcoin brokerage works, and what to think of when selecting a bitcoin company to do business with.

First we will look at the flow from a client’s perspective, and then from River’s perspective.

How Clients Can Buy Bitcoin

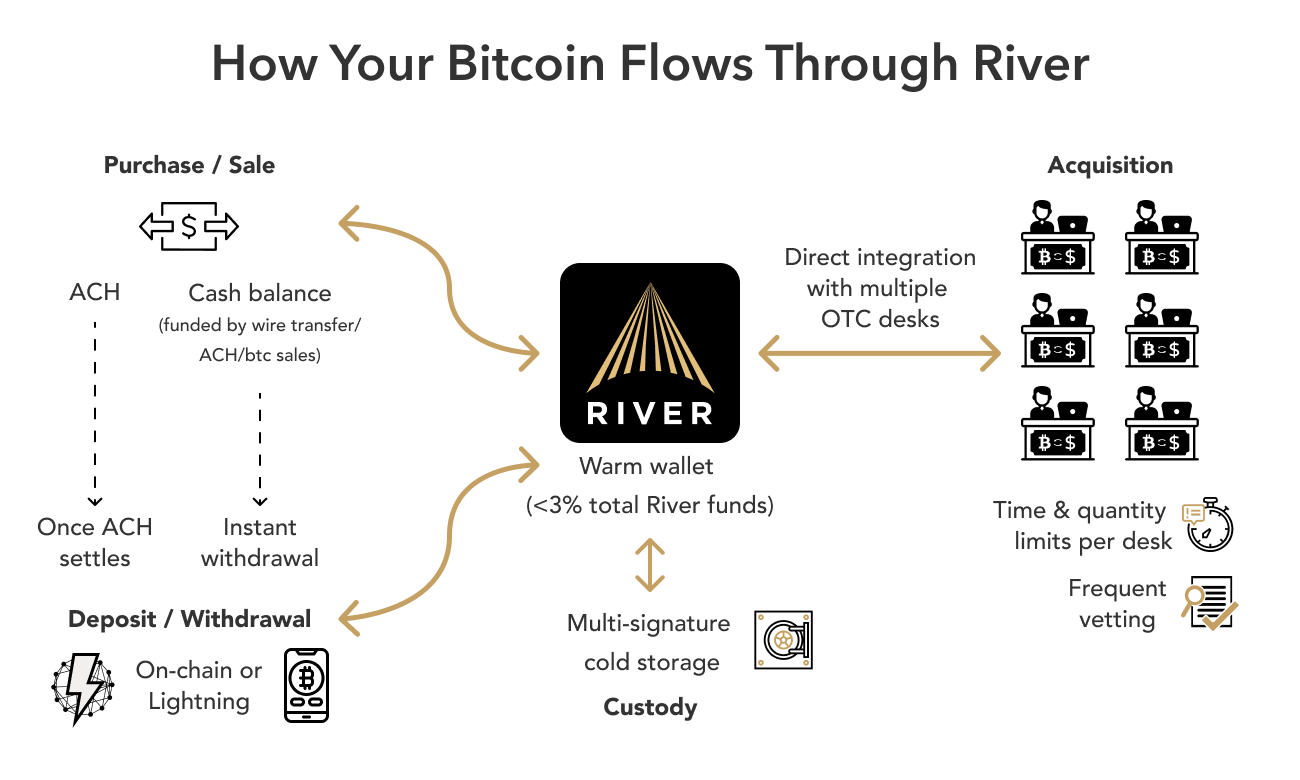

To buy bitcoin on River, clients can choose between an Automated Clearing House (ACH) transaction, or using their cash balance on the platform. Clients can fund a cash balance ahead of time through ACH, a wire transfer, or proceeds from a bitcoin sale.

When choosing an ACH transaction, the client authorizes a transaction from a linked bank account, which takes the banks 1-3 business days to process and typically takes about 5-9 business days to fully settle. In the meantime, River already procures the bitcoin at the current price and fronts the money for the client. Due to the return risk associated with ACH transactions, this bitcoin cannot be transferred off the platform until the ACH transaction is settled.

A faster method for a client to get bitcoin off the platform is by funding their River cash balance using a wire transfer, as no holding period is needed and the client can withdraw purchased Bitcoin immediately. This reduces a client’s time exposure to any third party control of their assets. The maximum limit is also higher here, up to $1 million worth of bitcoin per order can be purchased through the cash balance. Our Private Client team manually executes orders that are larger than $1 million.

Getting Clients the Lowest Bitcoin Price

Once a client places an order, River instantly forwards it to several high quality over-the-counter (OTC) desks that specialize in institutional-level trading volumes. Our software selects the best quote to ensure the client gets the best price we can find.

Why does this matter? Because not every company where you can buy bitcoin is doing this! As a result, many clients are overpaying for their bitcoin without even realizing it.

When the bitcoin price is most volatile, it is challenging for OTC desks to handle the volume and offer fair prices to everyone. During the FTX meltdown for example, some US-based companies were selling bitcoin at up to $1,000 per bitcoin over its actual market price, due to their dependence on a few, or in some cases one, OTC desks. It is not that these exchanges and brokerages are marking up the bitcoin and profiteering from volatile markets, but when they only work with one OTC desk that is experiencing a supply shortage, their system is automatically passing on bitcoin at a significantly higher price than a fair market value.

DCA Should Never Overpay

Buying from a company that only uses a limited number of OTC desks is not just an issue for one-time orders, but also for automated weekly or monthly recurring buy orders, known as dollar-cost averaging (DCA). Clients can overpay significantly without realizing it if their automated order goes through during a period with large price spreads. This is why it is important to work with a wide range of OTC desks like we do at River, and part of why we do not charge fees on recurring orders on our platform. Zero-fee DCA, baby.

De-risking Partners

When we accept an order from a client and forward it to an OTC desk, we owe the OTC desk dollars to settle the transaction and we expect to receive bitcoin in return.

Sometimes multiple orders come through before one of them settles, so we have both a time limit and an amount limit of how long we keep orders open with an OTC desk. If either of these conservative limits are met, we settle the transaction with them. This practice ensures that we are never at a considerable level of exposure across all trades or with any specific OTC desk.

Peer Review Makes a Healthy Market

Connecting to many OTC desks is not a matter of quantity, but quality. We reassess OTC desks on a regular basis. How much did we trade with them? What were their prices relative to others? Were they a reliable partner? Are they financially healthy with a good ratio of liabilities-to-assets? These assessments ensure we maintain partnerships with the highest quality OTC desks and we mitigate counterparty risks.

In return, our OTC partners also assess River on similar criteria. When they trust us, they are in turn willing to place large orders with their partners, knowing we will come through on our end of the deal. This ensures we can provide higher maximum buy and sell limits to our clients.

Custody & Withdrawals

Once we have purchased bitcoin for a client and added it to their account, the bitcoin is moved into our custody. Almost all of the bitcoin we custody for clients is stored in our cold storage wallet. We keep less than 3% of all reserves on a warm wallet, which we use to top up our hot wallet for client withdrawals so that anyone can withdraw their bitcoin at any time, for example to self-custody. All of these wallets are secure, but naturally we store less bitcoin on a wallet that is on an Internet-connected device.

River built, owns, and controls its own custody infrastructure to minimize risks to our clients’ assets. This is different from many other companies in the industry who use shared custodians, which carries a few risks many inexperienced users may not be aware of. A shared custodian often supports many risky business clients and assets, which could lead to insolvency in some cases. This may not lead to a loss of funds for a client, but could freeze their assets for a long period of time until these issues are resolved.

If instead of doing an on-chain transaction, a client wants to withdraw through the Lightning Network so they can start making instant payments at low cost, the process looks a bit different. First we add bitcoin from their balance to River’s, and then we use the balance we have in our River Lightning Services account to send the transaction over Lightning instead.

Being a Bitcoin Company

Why do we manage our own custody and trading partners so rigorously? To give you, our clients, the best possible experience and price, with the lowest risk.

Why doesn’t every company do this? Because it requires engineering and operational excellence, expertise on security, financial operations, capital markets, and risk management. Marketing is cheaper than all of these disciplines, and it is often enough to convince many people that each company holds these same high standards.