Inflation fears are finally being realized, with a broad range of assets seeing significant price appreciation in the past month. Many market participants expect this trend to have continued effects on the stability of U.S. markets. Tesla has expressed concerns about Bitcoin’s energy use and reduced its reliance on the currency. Palantir, UBS, and MoneyGram are among the companies increasing support for Bitcoin.

Commodity Prices Begin Feeling The Effects Of Inflation

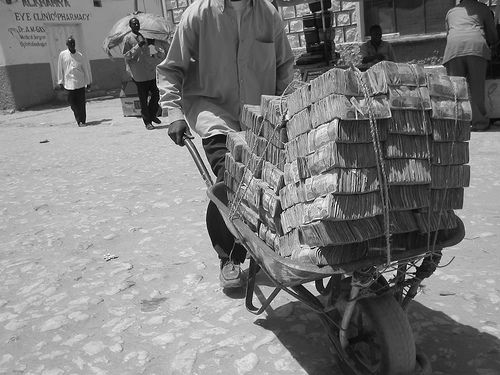

Inflation numbers have begun to reflect or even exceed investors’ expectations. The CPI rose by 0.8% in April alone, putting the index up 4.2% in the last 12 months. This is the largest annual increase for the index since the financial crisis in 2008. Industrial metals and other commodities’ prices have skyrocketed recently, causing ripple effects on pricing throughout the construction and housing industries. The producer price index is up 6.2% in the last 12 months, driven largely by recent increases in the price of steel.

Stan Druckenmiller expressed strong concerns about the future of the U.S. dollar due to current government programs. Druckemiller stated that he “can’t find any period in history where monetary and fiscal policy were this out of step with the economic circumstances, not one.” There were 473,000 unemployment claims last week, marking a new low since the start of the pandemic.

Tesla Backtracks Slightly On Bitcoin Support Due To Environmental Concerns

Tesla has temporarily halted its acceptance of Bitcoin as a payment method for products, citing the environmental footprint of the currency. The company plans to resume Bitcoin payments “as soon as mining transitions to more sustainable energy”. Additionally, Tesla plans to maintain ownership of the Bitcoin currently on its balance sheet.

MoneyGram announced that it will be allowing U.S. clients to withdraw cryptocurrency holdings in dollars. The feature will be supported through a partnership with Coinme. Palantir is now accepting Bitcoin as payment from clients. The company is also considering buying and holding Bitcoin on its balance sheet. UBS plans to support exposure to Bitcoin and other digital assets for its clients, although the specifics of the product offering are not yet finalized.

Large Corporations Express Optimism About Bitcoin

GBTC reached a new record discount of 21% relative to its NAV. A recent study conducted by NYDIG found that 46 million Americans now own Bitcoin, representing 17% of the adult population. Additionally, 55% of those who did not own digital assets said they would consider adding them to their portfolio.

Mark Zuckerberg released a photo of one of his pet goats named “Bitcoin”, sparking speculation about Facebook’s potential to use the currency moving forward. Tom Brady released a photo of himself with laser eyes; a graphic that has been known within the market to signify support of Bitcoin. Brady did not elaborate on the image.

Direct impacts of inflation have started to have profound effects on the economy. Economic indicators suggest that this trend may continue far into the future. Tesla’s updated stance on Bitcoin was a significant blow to investor optimism about the currency. However, several notable companies took new positive stances on Bitcoin in the past week.