In a conference on Friday, the Fed told markets to expect tighter monetary policy in the near future as they look to control high inflation levels. However, large spending measures by the Senate and House may counteract this tightening monetary policy. Blockstream closed a considerable funding round, which will help fund renewable Bitcoin mining projects. Afghanistan’s economy faces collapse as companies and governments continue restricting the flow of funds into the country,

Fed Tentatively Plans To Taper Asset Purchases

The Fed signaled tightening monetary policy at the Kansas City Federal Reserve’s annual economic conference last Friday. St. Louis Fed President Jim Bullard discussed plans for tapering securities purchases because inflation levels are well above target levels. Bullard expects to start tapering this year and “get the taper finished by the end of the first quarter next year.” Jerome Powell supported this plan due to signs of economic recovery and “clear progress toward maximum employment.” However, Powell acknowledged that the Delta variant has the potential to delay or reduce the purchasing taper. The S&P 500 rose 0.9% on Friday following Powell’s positive economic outlook. The House simultaneously set September 27th as the date to vote on the infrastructure bill and approved the $3.5 trillion spending plan framework.

Bitcoin Investment Accelerates As Latin American Bitcoin Adoption Progresses

Blockstream raised $210 million in a Series B, putting the company’s valuation at $3.2 billion. Blockstream is expected to use these proceeds to further its current product offerings, including Blockstream Energy, which aims to facilitate Bitcoin mining through renewable energy sources. Baillie Gifford and Infinex are the primary investors in the round. MicroStrategy purchased an additional 3,907 bitcoin for $177 million. This recent purchase brings the company’s total holdings to 108,992 bitcoin, worth roughly $5.2 billion. Cuba announced that it will recognize and regulate cryptocurrencies as a source of payments. The country is the latest Latin American country to embrace Bitcoin and other cryptocurrencies in a wave of adoption following El Salvador’s decision to make Bitcoin its national currency. El Salvador is set to enact this change on September 7th.

Afghanistan’s Economy Crumbles Under Taliban Rule

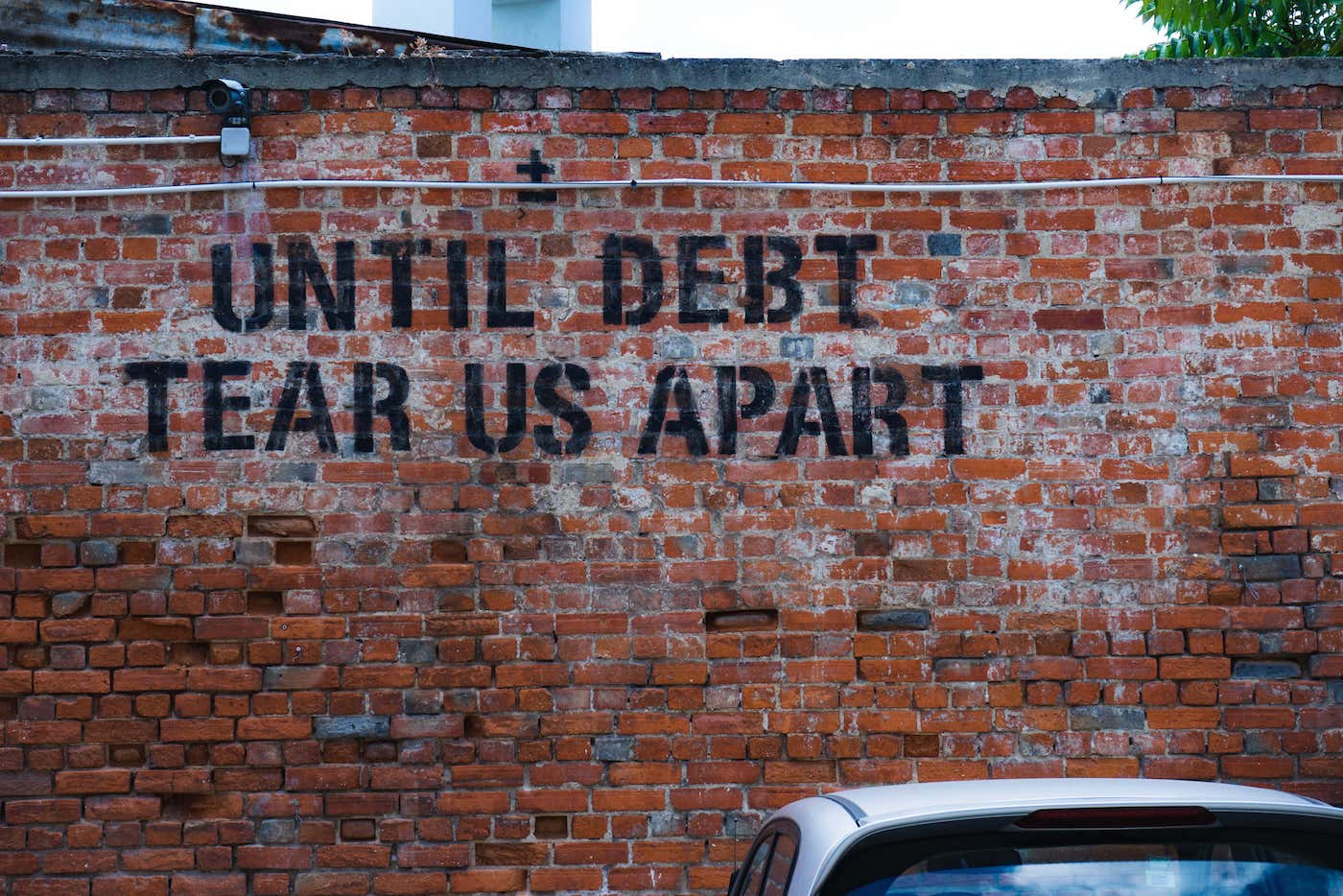

Afghanistan continues to feel the fallout of U.S. withdrawal from the region and the subsequent Taliban takeover. An attack at Kabul airport killed over 100 people, including 13 U.S. service members. The Afghan economy is dangerously close to collapsing. It faces pressure from all angles; the country has been almost entirely cut off from foreign aid, which previously represented 40% of its GDP. Banks are now forced to close due to a lack of funds as citizens rush to withdraw any cash they can. The afghani has rapidly lost value, with a current exchange rate of 86 afghani to one U.S. dollar. With most financial institutions cutting off services, Afghans are increasingly turning to barter and alternative currencies such as Bitcoin to conduct economic activity.

Market Recap

The Fed acknowledged that inflation levels are well above targets, even for COVID-level government spending. However, the tightening monetary policy seems far from guaranteed as the Delta variant renews economic uncertainty. Additionally, the infrastructure bill and budget plan are increasingly likely to be approved, resulting in massive capital injections that will bring additional inflationary pressures. The worsening situation in Afghanistan may lead to economic failure if banks and governments continue to cut the country off from foreign aid and financial services. Although the humanitarian crisis extends far beyond money, Bitcoin offers Afghans a censorship-resistant currency that doesn’t depend on the stability of their country.