Want to receive our newsletter at a regular cadence? Sign up here.

NFTs on Bitcoin?

Non-Fungible Tokens were one of the big hypes of the 2021 crypto cycle. Now they are back as a hot topic in Bitcoin circles, with the introduction of the Ordinals protocol by developer Casey Rodarmor.

NFTs are references to images, and these references are stored on a blockchain. They are intended to represent digital ownership and can be exchanged, but there is no legal basis that supports these ownership claims today.

Historically, much of the NFT activity happened on other chains, due to them having more functionalities built in to support a wide range of applications.

The interest from Bitcoiners also remained rather limited. The separation of money and state is a much bigger challenge than exploring new business models for creators.

With the introduction of the Ordinals protocol over the past week, NFTs under the name of “inscriptions” have now come to Bitcoin. It is causing quite a stir among bitcoiners.

Why do Bitcoiners care?

Unlike NFTs on other chains, these inscriptions/images are being stored directly in the blockchain, which means they’re on every full node in the network. This was an unintended side effect of Bitcoin’s most recent upgrade: Taproot.

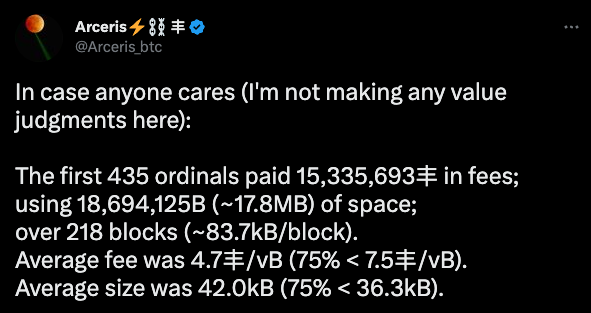

This is not a problem for Bitcoin today, there are only a few hundred of these inscriptions.

The symbol here is used by the writer to refer to satoshis, the smallest unit of a bitcoin.

People do care about the long term consequences of this possibility. There is over a decade of nuanced backstory to whether the Bitcoin blockchain should be used for applications other than money. Non-financial use cases can influence how the fee market develops for all users.

Mostly hype for now

Some people have called for soft forks or for miners to step up and filter these use cases out. These types of actions are a slippery slope towards censorship and central planning.

Unlike on other chains, users cannot create hundreds or thousands of NFTs at low cost. Inscriptions are assigned to one satoshi each, so there can “only” be 21 quadrillion of them. As a result, inscriptions will quickly become too expensive to get as much hype as NFTs briefly did. Many users expect that most of these inscriptions will be priced out of the market and the problem will solve itself.

We also believe this to be the most likely outcome, but we will be watching to see how the situation develops and keep you informed!