Want to receive our newsletter at a regular cadence? Sign up here.

Reservations on the (Federal) Reserve Printing 🖨️

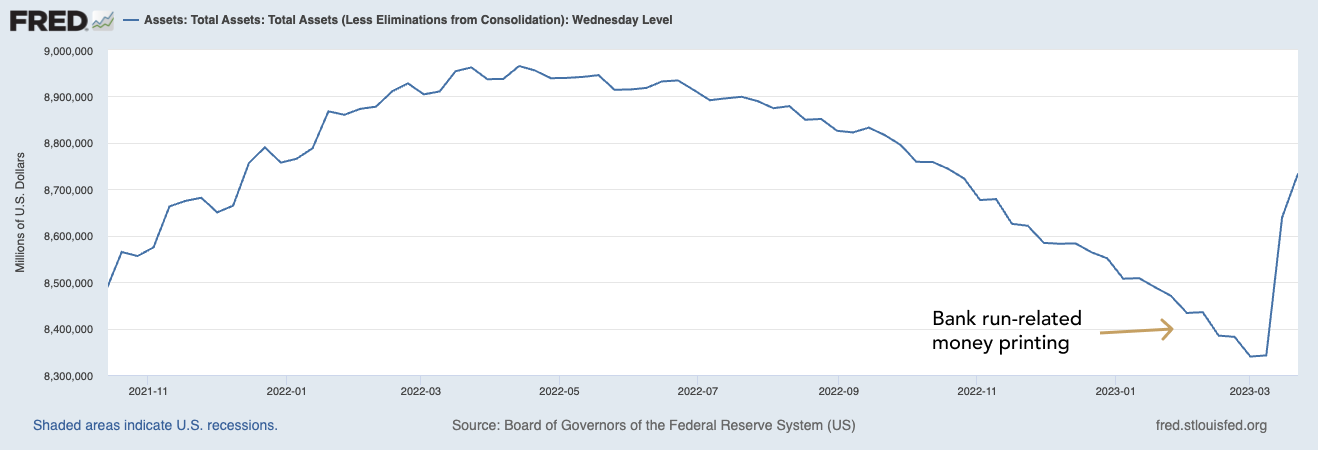

Last week the Federal Reserve started creating a significant amount of money to deal with its precarious situation.

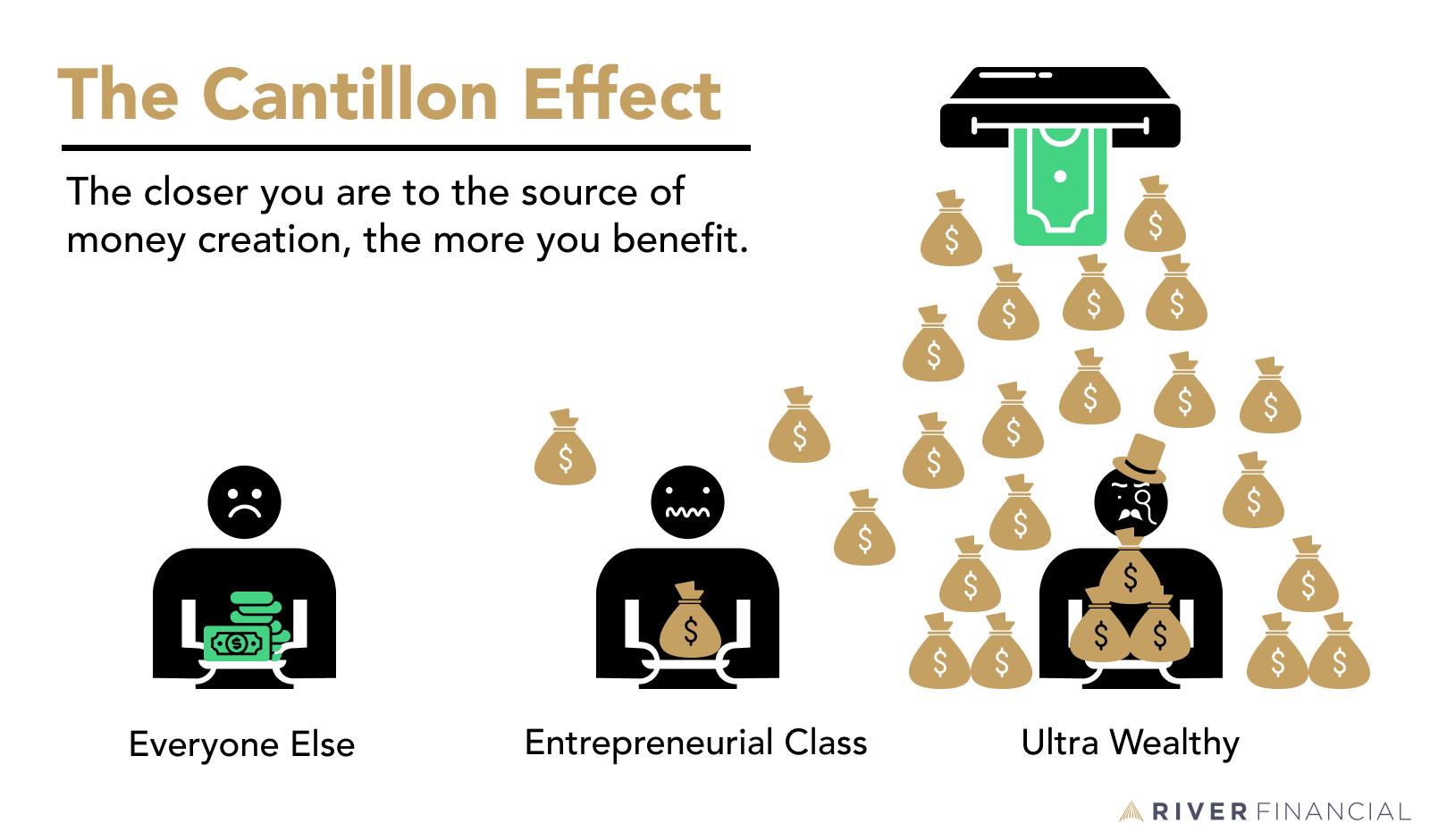

When the money printer turns on, we think about something called the Cantillon Effect. What’s that?

In a 1755 paper, Richard Cantillon described how when new money is created and injected into an economy, its effects on prices are unevenly distributed. Those nearest to the source of money creation stand to benefit most.

Since April 2020, Fed printing has increased the money supply by nearly 230%. More recently, the U.S. Government has printed enough money to undo months of balance sheet shrinking.

Guess where most of that money will be going per the Cantillon Effect?

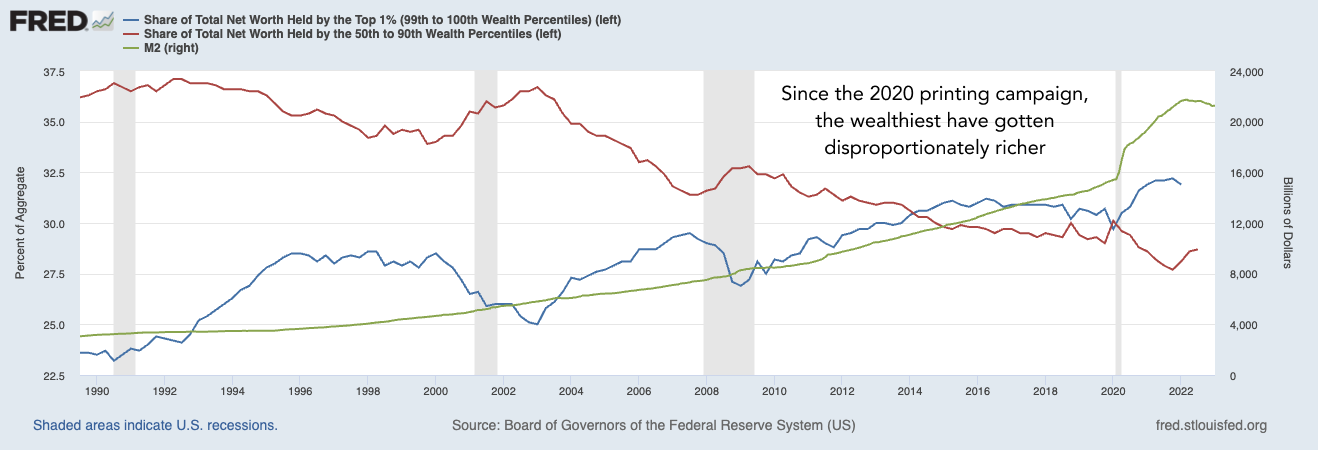

Here are 3 scenarios in history in which the wealth gap starts to reverse: 2001, 2008, 2020. Technological advancements are naturally a deflationary force (new tech enables us to get more for less), but there’s nothing the Fed fears more than deflation. This is when quantitative easing starts.

You can read more about the Cantillon effect in our River Learn article.

Bitcoin’s Hashrate Going Vertical 📈

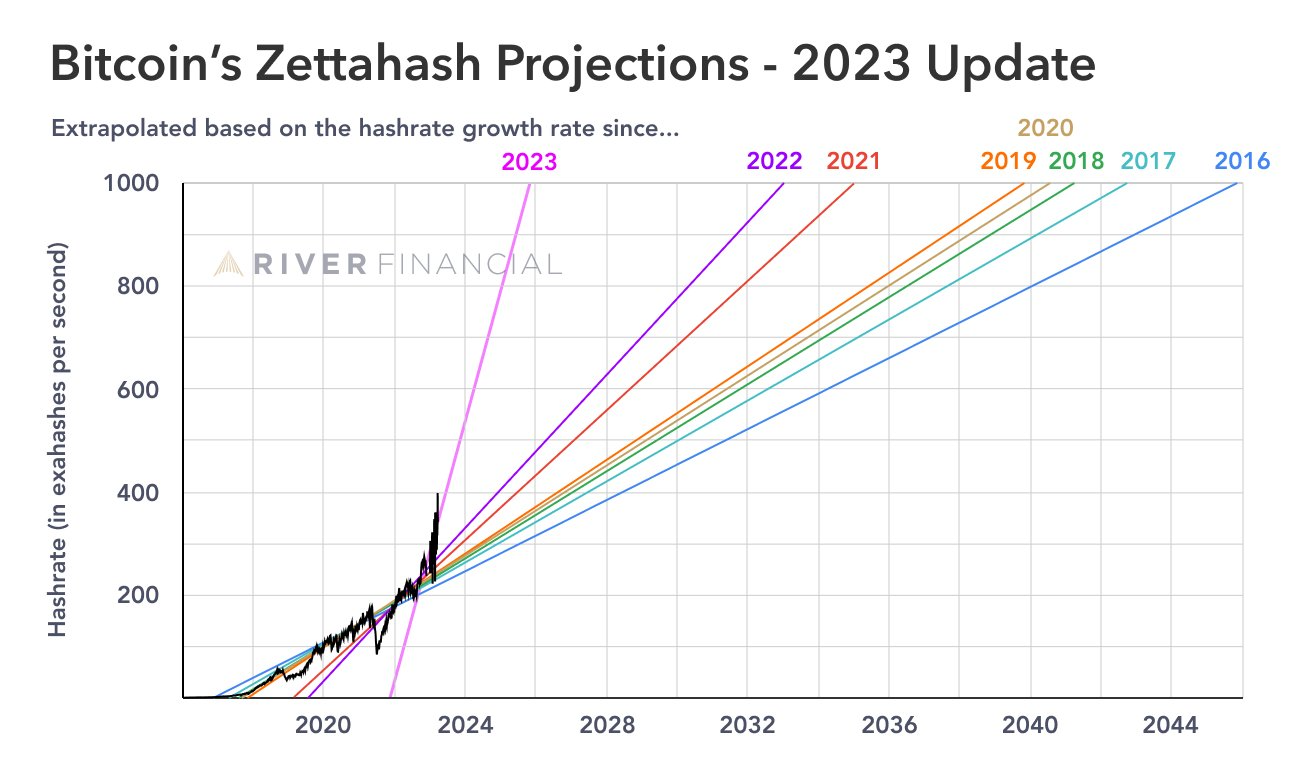

Bitcoin's hashrate just touched 400 Exahashes, growing 50% since the start of the year. At the current growth rate in 2023, we'd reach a Zettahash by the end of 2025–far ahead of initial predictions in our mining report.

What is happening?

We know that since January ~44 Exahash was added to the largest mining pool, Foundry, AntPool added ~29 Exahash, ~8 Exahash went to F2Pool, ~7 to Binance Pool, and -4 to Braiins Pool.

There is some speculation about nation-states being behind the hash rate growth. We find this unlikely. Mining operations at this scale are enormous and involve many people to run them. The odds of a nation state managing to gather and activate this much hash rate without anyone talking are astronomically low.

The answer of where the hashrate comes from is likely nuanced. It could be a mix of:

- Unused inventory going online

- New models getting out there

- More facilities going live (this can be a slow process)

- Crafty entrepreneurs finding cheap energy sources before regulators step in

- And other reasons

For more information check this Twitter thread from our research analyst.

Best of Bitcoin Twitter 🐦

- Greenpeace commissioned artist Benjamin Von Wong to create The Skull of Satoshi. The installation was meant to support Greenpeace’s “Change the [Bitcoin] Code” initiative but has instead served as a jumping-off point for the artist, Von Wong, to learn about Bitcoin’s potential to be a solution in environmentally-friendly energy generation. Our take: It is heartening to see good faith being shown both the online bitcoin community and someone like Von Wong who, in his own words, saw bitcoin mining as “a black and white issue.”

- Peter McCormack, host of the What Bitcoin Did podcast, sent a tweet cataloging in-person meeting spaces for Bitcoiners to congregate and learn from each other. One user shared a link to btcmap.org, a tool to locate and visualize communities around the world. Our take: Learning about Bitcoin online is great, but nothing beats asking questions and learning from bitcoiners in physical space.